The Best Financial Decision I Ever Made Was Paying Off My Mortgage

No question, hands down this was the best decision I could have ever made! We did this in a little less than 2 years with a $191,000 mortgage. The purchase price of the home was $398,000 so as you can see we put down a pretty sizeable down payment.

Even though it took my wife and I less than 2 years to pay off this mortgage….. this was journey that started about 10 years ago with the purchase of our first home. We lived in that house for 8 years and were able to sell it for a nice profit due in large part to the improving real estate market. My wife and I had outgrown this home with the addition of our first child and with hopes of having another so we decided we needed more space.

As we were looking at homes I made the decision early on to buy a house that we could easily afford. I knew we would be putting down a hefty down payment and I wanted to keep our mortgage below $1,000 per month. I have a mental block with spending more than this per month and I definitely did not want to get into a bad situation if one of us lost our job. We live in an area of the country that has a lower cost of living compared to the national average which has been huge in helping us keep our housing costs relatively low while continuing to build wealth.

Buying the Right House

I can’t stress how important buying the “right” house was for us. We were able to find a home in a good location that gave us the space we needed (4,000+ square feet) priced well within our means. We could easily have purchased a home that was 2X the purchase price of this home but I decided long ago that I wanted to be debt free and the mortgage was the only remaining debt I had.

Also I work in Corporate America but ultimately want to get out of the rat race so I see additional debt as a way of keeping me chained to my desk. Increasing my reliance on a corporate job is a nightmare worst-case scenario for me.

So once we purchased the house and I got a good sense of ongoing expenses and factored in the additional expenses of our second child we started attacking the mortgage with “gazelle intensity” to borrow a phrase from Dave Ramsey one of my favorite personal financial gurus. I also highly recommend his book the Total Money Makeover. This is one of the financial books that completely changed my outlook on personal finances and debt specifically.

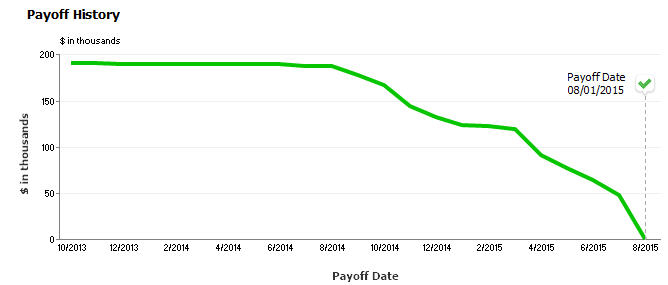

As you can see once we started aggressively paying down the mortgage we got super intense! Whenever I got a bonus from work or we had extra cash we would put it towards the mortgage. I had a goal of paying it off before the end of 2015 and we reached that goal 4 months early in August.

I would go each week or every other week to the bank to pay the mortgage down. I would go inside to make the payment and it got to the point that many of the tellers knew me. Ha! I did this after my Saturday workout to create a routine that would force me to pay it down and not get discouraged.

Deciding to payoff your mortgage is a very personal decision that only you can make and determine if it is right for you. I read countless articles from financial pundits and comments on blogs saying that it is a terrible idea to lock up your liquid cash in your home vs investing in the market to get a much better return. I can understand this logic but my mortgage was 4.5% and I liked the idea of having this as a guaranteed return from paying down the mortgage.

Also I have a significant stock portfolio and a few other paid off rental properties so I feel diversified. In hindsight given the ups and downs of the stock market this year – the SP 500 has been flat – I am even happier I decided to take the plunge and wipe out this debt.

Top Reasons We Paid Off Our Mortgage Early

- I would like to leave corporate at some point and being debt free will make this so much easier since my monthly expenses are low. I am 40+ years old and the idea of being able to spend my time the way I see fit is extremely attractive.

- I hate debt. This can’t be understated. I absolutely despise the idea of owing someone anything.

- I wanted the satisfaction of truly owning our home!

- Freedom – this ties in to reason #1 but paying off our home has given us so many more options with our discretionary income. I plan to purchase another rental property in the next few months to further increase our passive income. I will write a post on this later but I am a huge fan in investing in rental properties and have been doing so for about 8 years. Again since I hate debt I purchase these properties with all cash.

- Less stress – I no longer have to worry if I will have a roof over our head. Even if we both lose our jobs our passive income more than covers insurance and property tax. Ironically this freedom has also allowed me to take more risks at the office and speak my mind which as improved my performance. This was an unexpected outcome for me but it has been so freeing to know that I am going to work only because I want to not because I need to and that I can walk out at anytime.

Conclusion

Like I said paying off my house has been the best financial decision for me. It has been satisfying on so many levels.

Please feel free to comment below. What do you think about paying off your house?

5 Comments

Very inspiring! I hope to one day pay off my home but I have a long way to go!

Paying off my house 4 years ago was the best thing I could have done. When I lost my job a few years back it was one less thing to worry about.

House will be paid off by the end of this year. I’m a huge believer in living within your means.

Can’t wait to pay off my mortgage. About 6 years left and then….FREEDOM!!!!

Husband and I paid off house on Friday! What a great feeling! Ready now to change my family tree.